By any standard the Chartered Financial Analyst (CFA) designation is perceived to be the premier global investment management credential. It shows that they truly understand financial analysis, portfolio management and ethics. But the CFA charter is not an easy certification to obtain. CFA exams are some of the hardest and most intense financial examinations in the world – many compare it to lawyers’ taking on bar exam or physicians’ passing USMLE.

The path to becoming a CFA charterholder requires intellectual ability as well as tremendous endurance, diligence and dedication. So, in this article will unearth the intricacies of CFA exams, and what it takes to clear these exams with some well-thought-out strategy while also touching on how much weightage or importance does a person actually have if he/she possesses CFA charter?

Contents

The Prestige and Significance

The CFA Charter is a highly regarded credential in the financial sector, valued globally by employers and clients so it should be an obvious choice for you. How Is the CFA Designation Different from a Prestige Certification — It serves as an affirmation of competency for almost 70% in practicing financial or wdbos login investment analyst and champion adherence to high competence ethical standards. The organization that awards the charter, CFA Institute has a very broad curriculum and includes among others equity analysis, fixed income analysis, derivatives (futures contracts), alternative investments (private equity) etc.

The value of the CFA charter is that it can help you to kickstart your career in finance by providing access to a wide range of opportunities. Charterholders are in demand by employers to manage portfolios, perform research and come up with investment ideas for stocks or bonds. Research says the credential is a way for employers to know that candidates like Laura are unique in an increasingly crowded job market. In addition, the CFA curriculum is built around an ethical base that ensures charterholders are not only qualified but also pledge to act with integrity and in a professional manner.

The CFA charter is more than a series of exams—it’s joining an international organization of financial professionals who have the same high standards for ability and integrity. A Charterholder remains on the leading edge of industry developments and best practices throughout their career, while maintaining a strong commitment to quality education.

The Structure of the Exam

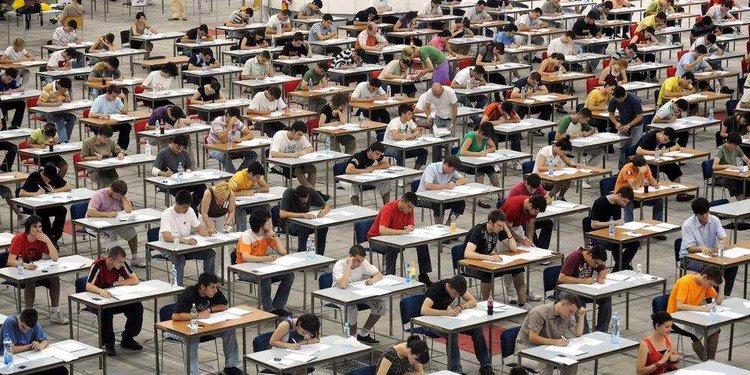

The CFA exam is structured into three levels, each progressively more challenging and covering different aspects of financial analysis and investment management. The exams are known for their depth and complexity, requiring candidates to not only understand the material but also apply it in a variety of contexts. The pass rates for the CFA exams are notoriously low, with many candidates needing to retake one or more levels before finally earning the charter.

1. CFA Level I: The Foundation

The CFA Level I Exam is the first of 3 exams required to fulfil your dream to become a Chartered Financial Analyst. This is seen as the easiest reading level, but this says nothing about its ease. A 3-hour, multiple-choice examination consisting of 180 questions (split into two sets) on Level I. The content is like Ethical and Professional Standards; Quantitative Methods, Economics, Financial Reporting and Analysis.; Corporate Finance, Equity Investments Fixed Income: Derivatives Alternative investments Portfolio management Wealth Planning.

Level I: Focuses more on common concepts and high-level principles. Should understand a bit about finances: i.e. Speak the language and be able to do basic math But the sheer volume of material taught at level I can seem impossible to juggle, with candidates required to be ready for everything. The examination assesses a lot more than your rote memorization skills; it evaluates how well you apply these concepts in practical, across-the-board circumstances.

2. CFA Level II: The Application

Level II of the CFA exam is often regarded as the most difficult of all three exams. It moves the learning from core finance to applying financial notions and theories. The Level II exam includes 88 item sets — each with a vignette and four to six multiple-choice questions. Level II: This exam covers the same topic areas as Level I, however, much more depth is provided for each area and the questions are mostly item-set format.

Level II is often referred to as the “analyst level” since this stage involves using knowledge to analyze financial data, assess investment opportunities and then recommend a strategy. The exam evaluates whether you know how to read financial statements in order to calculate the value of a company and decide if it is doing well, as well as test your ability to predict what will happen with investments based on specific economic or market conditions. The item set format of the exam requires candidates to read and comprehend a scenario background section, and then solve problems that may require multiple calculations or inferences from judgment based on that material.

The sheer quantity and complexity of materials covered in Level II is overwhelming. The exam is not just about learning material but also demands applying and integrating hundreds of hours worth of understanding across many subject areas in finance — for most candidates, this translates into a significantly higher amount of study time compared to Level I.

3. CFA Level III: The Synthesis

The CFA Level III exam is the ultimate goal on your journey to become a CFA charterholder. The emphasis is on portfolio management and wealth planning, to make sure candidates deliver a synthesis of his overall knowledge. The Level III exam is composed of a morning structured response (essay) section and an afternoon item set section.

Level III is difficult, mainly because of the long formatted-answer-style questions in the morning portion. It challenges them on elements that are not just understanding financial principles, but actually being able to express advanced financial concepts in simple black-and-white terms. Various questions around case studies cite examples of areas are asking the candidates to lay down a strategy for investment and provide reasons as due rational behind it, work across client situational read outs or types according to certain demands mentioned in the prompt along with impact evaluation on portfolio performance under influences.

The afternoon session of Level III is similar in format to Level II, with item sets based on vignettes. But the emphasis is more on investment and managing multiple asset classes in a coherent, cohesive manner. The exam will test the candidates to put together portfolios that meet client goals under constraints like risk tolerance, time horizon and tax considerations.

Level III is typically referred to as the “portfolio bracket” because this level required knowledge which are must whenever someone try managing real world investment portfolios. The exam has been designed to demand candidates think critically and strategically, leveraging their knowledge in a manner that demonstrates the multifaceted nature of real world investment management.

Challenges Faced by CFA Candidates

The journey to becoming a CFA charterholder is fraught with challenges that test the limits of a candidate’s intellectual and emotional endurance. The CFA exams are known for their difficulty, with pass rates that hover around 40-50% for each level. Many candidates find themselves needing to retake one or more levels before finally passing all three exams.

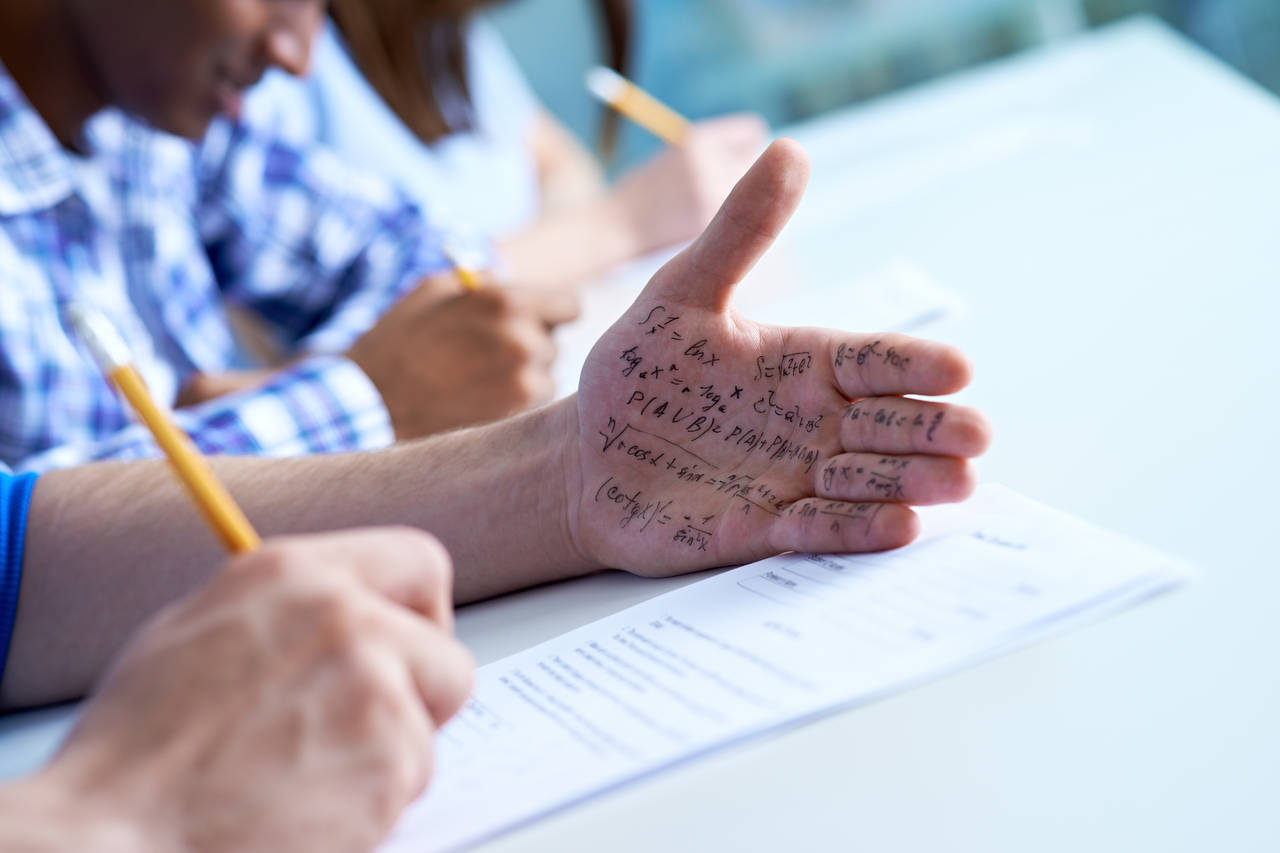

One of the primary challenges faced by CFA candidates is the sheer volume of material that must be mastered. The CFA curriculum covers a vast array of topics, each with its own set of complex concepts, calculations, and applications. Candidates must be able to move seamlessly from one topic to another, often within the same exam, and apply their knowledge in a variety of contexts. This requires not only a deep understanding of each subject but also the ability to retain and recall information over a long period of time.

Time management is another critical challenge. Most CFA candidates are working professionals who must balance their study time with their job responsibilities, family obligations, and personal lives. The CFA Institute recommends that candidates spend at least 300 hours studying for each level, but many find that they need to devote even more time to fully grasp the material. The long hours of study, combined with the pressure to pass the exams, can lead to significant stress and burnout.

The psychological stress associated with CFA preparation is considerable. The high stakes of the exams, combined with the fear of failure, can take a toll on candidates’ mental health. The pressure to succeed is often compounded by the knowledge that many candidates do not pass all three levels on their first attempt. This can lead to feelings of self-doubt and frustration, particularly when a candidate has invested significant time and effort into their studies.

Strategies for Success in the CFA Exams

Successfully navigating the CFA exams requires a well-thought-out strategy that combines disciplined study habits with a strong support system. Many successful candidates emphasize the importance of starting early and developing a consistent study schedule. Given the breadth and depth of the material, it is crucial to break down the curriculum into manageable sections and allocate sufficient time to cover each topic thoroughly.

One of the key strategies for success in the CFA exams is effective time management. This involves not only planning study sessions but also balancing work, personal life, and relaxation to avoid burnout. Many candidates find it helpful to create a study calendar that outlines their study goals and tracks their progress. This allows them to stay on track and ensure that they have covered all the material before the exam date.

Practice is another critical component of CFA exam preparation. The CFA Institute provides candidates with a wealth of practice questions and mock exams, which are invaluable for building familiarity with the exam format and improving test-taking skills. Regular practice helps candidates identify areas where they need to improve and refine their approach to answering questions. It also builds confidence and reduces anxiety on exam day.

The CFA Journey: A Test of Endurance and Resilience

The journey to becoming a CFA charterholder is not just an intellectual challenge; it is a test of endurance and resilience. The CFA exams are designed to be difficult, and many candidates do not pass all three levels on their first attempt. This can be a humbling experience, but it is also an opportunity for growth. The process of preparing for the CFA exams teaches candidates valuable lessons about discipline, perseverance, and the importance of continuous learning.

For many candidates, the CFA journey is a long and arduous one, requiring years of dedicated study and sacrifice. It often means balancing work, family, and personal life with the demands of a rigorous study schedule. The pressure to succeed can be intense, and the fear of failure is always present. However, those who persevere through the challenges and ultimately earn the CFA charter often find that the rewards are well worth the effort.

The CFA journey also fosters a sense of camaraderie among candidates. The shared experience of preparing for one of the most difficult financial exams in the world creates bonds that can last a lifetime. Many candidates form study groups, attend review courses, and participate in online forums where they can share resources, ask questions, and offer support to one another. This sense of community is one of the most rewarding aspects of the CFA journey, and it helps to mitigate the stress and isolation that can come with such an intense pursuit.

Conclusion: The CFA Charter as a Gateway to a Rewarding Career

Becoming a CFA charterholder is a significant achievement that opens the door to a rewarding and challenging career in finance. The CFA exams are among the most difficult in the world, requiring a deep understanding of a wide range of financial topics, as well as the ability to apply that knowledge in real-world scenarios. The journey to earning the CFA charter is not easy, but it is a journey that builds character, resilience, and a strong foundation for a successful career.

The CFA charter is more than just a credential; it is a symbol of excellence and integrity in the financial industry. It represents a commitment to the highest standards of professional conduct and a dedication to continuous learning and improvement. For those who earn the CFA charter, the rewards are not only in terms of career advancement and financial success but also in the satisfaction of knowing that they have achieved one of the most respected credentials in the industry. If you like reading this article then please consider reading our article about Algarve.